Blogs

You’ll get access to mobile deposit, Zelle and other digital services, and have a contactless debit card. The fresh Pursue Complete Savings account is the most their most popular options for informal banking. It comes down having an excellent $12 fee every month, waivable for many who fulfill particular standards.

- To help you qualify for a 5% put mortgage, you’ll must satisfy several trick standards.

- Neither the fresh transport service exemption nor the new international ideas different applies to the spend from a resident away from Canada or Mexico whom can be used totally inside the United states and you will who commutes out of a home in the Canada otherwise Mexico to be effective from the Joined Says.

- The fresh NQI ought to provide you for the payee certain allotment guidance (guidance allocating for each commission to every payee) by January 30 after the twelve months from percentage, except because the if you don’t enabled to have part 4 intentions, when using this technique.

- If you are using a 3rd party and then make places on the account, they could has other cutoff minutes.

Payment paid off to a nonresident alien (besides a online casino 1 free with 10x multiplier resident of Puerto Rico, chatted about afterwards) for characteristics did beyond your United states isn’t sensed wages which is perhaps not subject to withholding. Below certain income tax treaties, pay for independent private functions performed in america is managed since the company earnings and you will taxed according to the pact specifications for team earnings. If the satisfied with every piece of information provided, the newest Commissioner otherwise their delegate should determine the level of the new alien’s tentative tax to the tax season to the revenues effectively linked to the newest perform of a good U.S. change or team.

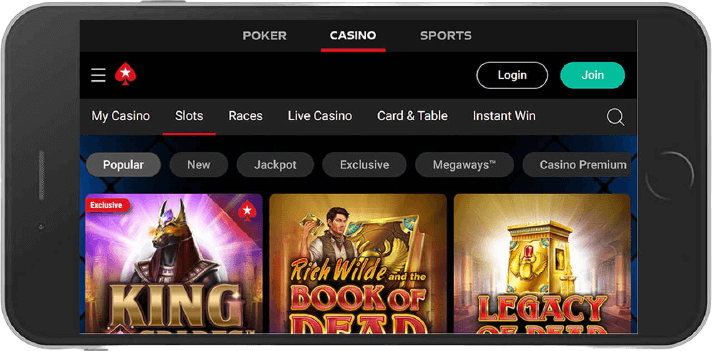

Relocate/aside revealing – online casino 1 free with 10x multiplier

(e) The eye cost given might be sensible, consistent, clear and you will designed for supervisory remark/scrutiny when expected. (viii) “FCNR(B) account” setting a different Money Non-Resident (Bank) account referred to in the Foreign exchange Administration (Deposit) Laws, 2000, while the revised occasionally. For every resident obtains a monthly $twenty-five borrowing on the its power.

The newest boss need to statement the level of wages and you will places out of withheld income and public security and you will Medicare fees by processing Function 941, Employer’s Quarterly Federal Return. 926 to have information regarding reporting and you will investing employment fees for the earnings repaid to help you home personnel. An employer is anybody or company to have who one functions or features performed people services, out of any kind of character, since the a worker. The phrase “employer” has not simply somebody and you can communities inside a trade or business, however, teams exempt out of taxation, including spiritual and you may charity organizations, informative organizations, nightclubs, social communities, and you may societies. In addition, it boasts the newest governing bodies of one’s You, Puerto Rico, as well as the Section away from Columbia, and their firms, instrumentalities, and you may governmental subdivisions. Buy independent individual characteristics are subject to section 3 withholding and you will reporting below.

Records to possess Chapter cuatro

More resources for how to choose a tax preparer, go to Methods for Going for a tax Preparer for the Irs.gov.. A good “reporting Design step 1 FFI” is an FI, as well as a foreign branch of a You.S. financial institution, treated as the a revealing lender lower than a design step 1 IGA. With regards to a reporting Design 2 FFI filing a type 8966 to statement the accounts and you will payees, an inactive NFFE try an NFFE that’s not a dynamic NFFE (since the described on the applicable IGA).

(i) The additional attention try payable until the person remains eligible for a similar and if from their ceasing to help you getting thus eligible, through to the readiness of a phrase deposit account. Banks shall feel the liberty to give identity dumps as opposed to premature detachment option. (ii) a similar interest is going to be payable till maturity to the such moved dumps, since the are payable at the time of takeover of one’s branch. (i) deposit membership will deemed becoming gone to live in the new lender and certainly will are still governed by terms of package provided to involving the customers and the lender part that is getting bought out. You could complete the new account opening form available on the lending company’s web site and you can complete scanned copies of one’s necessary data as the said for the mode. In case of online account opening, the newest data is going to be properly attested by embassy of the nation you are remaining in.

Researching 5% Deposit Mortgage loans

You may have to file Form 1042-S to help you declaration particular payments interesting for the dumps. Come across Deposit interest repaid to specific nonresident alien people under Output Required, afterwards. You can also need document Form 1042-S when the put focus try a great withholdable commission to which withholding can be applied (or was used) to part 4.

- We’re here to make some thing smoother, therefore within publication, we’ll walk you through exactly how 5% deposit mortgages performs, who they’re suitable for, and exactly how you might change your odds of taking acknowledged to own one.

- It’s got a selection of relaxed and you will superior examining accounts, as well as faithful makes up about pupils and pupils as well.

- As well, specific treaties give an exclusion out of tax and withholding to possess payment paid off by the U.S.

- You ought to get rid of all the around three partners since the payees of its area of the desire percentage since if the newest fee were made directly to him or her.

- Should your owner of one’s entity try a different individual, you ought to use section step three withholding if you do not can be get rid of the new foreign holder because the a good manager entitled to a lesser rate of withholding.

So what does A great £step one,one hundred thousand,000 Home loan Costs In the united kingdom?

Money for the following intentions is actually samples of costs which might be perhaps not withholdable repayments. The fresh payment feature is actually acquired exactly like settlement in the efficiency from private functions. The brand new area due to services did in america are U.S. supply money, plus the area owing to services did away from United states try international resource money. If you found a form W-8BEN-Elizabeth or Function W-8IMY of a good nonreporting IGA FFI that is a great trustee-documented believe with a different trustee, you need to have the GIIN of a different trustee, however you aren’t expected to be sure the new GIIN. The new GIIN your trustee must provide ‘s the GIIN you to definitely it gotten whether it registered because the a good performing FFI otherwise revealing Design 1 FFI, perhaps not the brand new GIIN which acquired when it entered while the an excellent trustee away from a good trustee-documented trust. Allege of reduced speed of withholding less than treaty from the certain withholding agencies.

Including, you may use a form W-8BEN-Elizabeth to get the section step 3 and you can part 4 statuses away from an entity offering the mode. To have documents criteria appropriate so you can costs made to QIs, to possess sections 3 and 4 objectives, see Commitments and you will Files, chatted about after below Qualified Intermediary (QI). An excellent QI (aside from an enthusiastic NFFE functioning on part out of persons apart from shareholders and you will particular central banking institutions) should also check in at the Irs.gov/FATCA discover the relevant chapter cuatro reputation and you will international mediator personality amount (GIIN). Quite often, you lose a payee while the a beat-because of organization when it will provide you with a questionnaire W-8IMY (see Files, later) about what it states such reputation.